If You have $ 1 Million and you compound it @ 36%; in 60 years, you will own the World, i.e. You will have $ 100 Trillion, more than double the GDP of the world today, i.e. the power of compounding.

Simply put, compounding refers to the re-investment of income at the same rate of return to constantly grow the principal amount, year after year.

Compounding does wonders in the long run not because of time value of money but because return gets added to the principal at the end of every year thus increasing the principal and reaping the benefit of return on the increased principal.

The compound effect is the strategy of reaping huge rewards from small, seemingly insignificant actions. Even Albert Einstein described compounding as ‘The most powerful force in the universe‘.

I have always relied on some of my favourite stories to highlight the power of compounding.

The story of the “Peasant and the King’ comes from the book ‘Classics – An Investors Anthology.”

There was the king who held a chess tournament among the peasants and asked the winner what he wanted as his prize. The winning peasant, in apparent humility, asked only, that a single kernel of wheat be placed for him on the first square of his chessboard, two kernels on the second, four on the third-and so forth and the kernels be doubled on every square till the 64thsquare. The king thought, what a fool, what a small gift he is asking for and fell for it. The entire stock in his granary was soon exhausted and he had to import grain from Argentina for the next 700 years. Eighteen and a half million trillion kernels [18,500,000,000,000,000,000] or , if each kernel is a quarter inch long, to stretch to the sun and back 391,320 times. That was nothing more than one kernel’s compounding at 100 percent per square for 64 squares.

This story really does highlight the absurdity of achieving 100% returns a year. Assume a 20 year old lives to 84 years equivalent to 64 chess board squares, of investing years and starts with $1, Doubling his stake every year, the man would end up with $18,500,000,000,000,000,000.

Lets use another example, What if you had two options, Take Rs 100 lacs on day 1 or a magical one rupee, which will double every day for 31 days. What would you opt for? Do a mental calculation, Calculate for yourself and decide now which option you want; Rs 100 lacs may seem a lot but Re 1 doubling every day for 31 days would amount to Rs 107.37 crores on the 31stday.

To highlight the power of compounding further, let me share an example of our interaction with a lot of young people. When we tell some of our young friends, aged 25 years, that lets plan for a retirement corpus of Rs 100 crores for you at the age of 65, they are awestruck and can’t even think of achieving that in their wildest dreams. However, if we tell them that it will only take a SIP of Rs 44000 per month or Rs 5 lacs per year @ 15% return to achieve it, they are dumbfounded as they can almost afford it. Going further, we tell them it will only take a SIP of Rs 17500 to start as long as you keep on topping it up with 10% every year as your income increases and they look at us as if we have come from another planet. But that my friends is not rocket science but the Power of Compounding, which we just don’t comprehend.

In another example, it is said that Peter Minuit purchased Manhattan Island for $24 worth of trinkets in 1626. A letter written by Dutch merchant Peter Schaghen to directors of the Dutch East India Company stated that Manhattan was purchased “for the value of 60 guilders” in goods, an amount worth approximately $1,050 in 2015 dollars. For this, Peter Minuit received 22.3 square miles which works out to about 621,688,320 square feet. While on the basis of comparable sales, it is difficult to arrive at a precise appraisal, but lets say a current rate of $1500 per square foot, will give a current land value for the island at close to a $ 1 Trillion.

To the novice, perhaps this sounds like a decent deal.

However, If the Indians had achieve only a 6.5% return, they would have had a last laugh last because at 6.5 %, $24 becomes $ 1.35 Trillion in these 393 years , and if they just managed to squeeze out an extra half point to get to 7%, the present value becomes $ 6.56 Trillion and at 10% return, The Indians would have a corpus of

$ 444, 156,997,781,046,032.89 and at 15% return, it would have been $ 17,157,835,537,539,586,291,391,158.32 in 2019 ( and if you work out, how much it amounts to, Please let me also know as it is beyond my calculation and imagination); That is the power of compounding.

We all get impressed by the absolute returns of real estate over a period of time, but to check the claims, lets look at it in another way.

A friend bought a property for Rs 30 lakhs in Mid 2002. He sold the property at Rs 1.5 Crores in 2018; a profit of Rs 1.2 Crores on an investment of Rs 30 lakhs. Many of my other friends were super impressed with the profits, which this friend made; but I was not as impressed as my other friends.

Let me explain why; While this friend’s absolute returns were good, Lets use the metric of Compounded Annual Growth Rate (CAGR) to evaluate the performance of investments. The CAGR of my friend’s investment was 10.6%. While this was more than returns from FD or other risk free investments, top performing diversified equity mutual funds over the last 15 years have given more than 15% CAGR returns. If he had invested in Equity Mutual Fund, Rs 30 lakh would have grown to Rs 2.44 crore @ 15% CAGR over 16 years.

If he had invested Rs 30 lakh as a Lump sum amount in HDFC EQUITY FUND on 25-01-2002 ( NAV Rs 19.47), Today the Current Value( As on 22ndMarch, 2019) of his Fund would have been Rs 10.24 crores (NAV Rs 664.57). at a CAGR of 23.07%.

Similarly Reliance Growth Fund was launched on 08.10.1995 at Rs 10 and is currently at a NAV of 1092.47 as on 22ndMarch, i.e. it has given a Compounded Growth of 22.64%.

A SIP of Rs 25000 per month in Franklin India Prima Fund since last 25 years resulted in a corpus of Rs 18.52 cr as against a total investment of Rs 75.0 lacs; giving a CAGR of 21%. However if you had invested in the same fund and done a top up in the SIP amount every year of only Rs 5000 per month, the total corpus would have been Rs 36.20 cr.

That is the power of Equity Mutual Fund and the kind of growth you can expect if you invest regularly in the right asset class. Don’t be impressed by absolute returns, always evaluate the return on your investment on CAGR basis to get the right picture.

Historically, inflation has been in the range of 6-7%. Based on historical prices, equities have given a return of 12%-18% and even averaged above 20% per annum during the period 1980 to 1996 and then again between 2004-2007. Given that equities can deliver a CAGR of 12-15%, your equity portfolio will beat inflation, delivering a healthy 4%-7% post-tax, post-inflation, real returns.

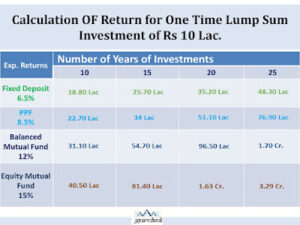

If you invest in a Bank Fixed Deposit earning an interest rate of 7%, after 20 years, Rs 1 lakh would grow to Rs 3.87 lakh. This is about half the corpus of the investment earning 10% per annum. If you were able to invest in a product that earned 14% p.a., the Rs 1 lakh investment would now be would worth a whopping Rs 13.74 lakh.

Clearly, a small difference in interest rate can make a huge difference in returns and your corpus over the long term.

Even a SIP of Rs 5000 per month invested in different asset classes giving different returns also translates into major difference in corpus over an investing period of 30 years as highlighted below.

If one has time to learn just one thing about investing, then it should be the power of compounding.

No one understood and used the power of compounding better than Mr Benjamin Franklin. The noted American revolutionary, diplomat and inventor was also the one to advise: ‘A penny saved is a penny earned’

Before he died in 1790, Mr Franklin bequeathed the cities of Boston and Philadelphia 1000 sterling ($2200 approx.) each. However, he put a few conditions. The interest was to augment the principal continually, and at the end of 100 years, 75% the fund was to be expended for “public works”, and the balance was to be compounded for another hundred years. Mr Franklin had prescribed an annual rate of just 5%.

In 1990, when the cities received their balances after 200 years, the combined bequest had grown to $6.5 million!!

This is certainly a testament to the power of compounding, the very thing Ben Franklin counted on and wanted to demonstrate.

The key to understanding how compound interest works is to realize the role of time. The earlier you push the compound interest button, the more impressive the long-term results. Give maximum time to your investment to get the most out of the power of Compounding as is illustrated below.

In a fictional scenario, lets assume, Mr X starts investing at the age of 18 and invest @ Rs 50000 per year till he is 25 years old, i.e. he invests a total of Rs 4.0 lacs and his corpus grows to Rs 12.08 crores when he is 60 years old. Mr Y starts investing at the age of 25 years and invests @ Rs 50000 per year till he is 60 years, i.e he invests Rs 18.0 lacs but still he has a corpus of only Rs 6.71 cr when he is 60 years.

It might sound incredible, but despite Mr Y investing about Five times the money that Mr X did, Mr Y ended up retiring with only about half what

Mr X was able to save.

How in the world can we explain the massive difference? This is only due to the power of compounding because Mr X has given more time to his investments to grow.

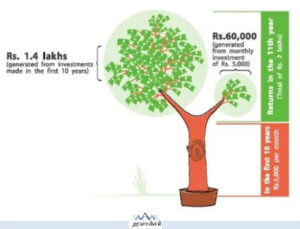

Early investing is very much like growing a tree; if you can take good care of it at the start, it will take care of itself later.

Growing your wealth is similar to growing the new tree.

Given lots of tender care, your small baby steps will become your Mighty Money Tree. Your investments in first 5 years out of a 30 year period makes the final 50% corpus and the investment made in the balance 25 years makes the rest of the 50% corpus. That means, the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus.

Money might not actually grow on trees, unless you plant your own Mighty Money Tree, and plant it very early!

Translated into a human lifetime, it means that starting to save at the age of 30 instead of 50 can mean retiring with four times the wealth.

As compounding helps to grow your money and wealth, reverse compounding can actually destroy your wealth even before you realise it. Compounding is the biggest wealth creator and reverse compounding is the biggest wealth destroyer.

Credit cards, mortgages, loans and other debt have interest payments on top of principal, which can accumulate to an unmanageable mountain of debt. Interest is paid either annually, monthly or a term in between. The higher the compounding frequency, the higher your accumulation of interest. Taking steps to reverse compound interest is the first step to debt management.

One of the most common debt trap is the payment of minimum charges on your credit card bill, which will only keep increasing your debt and nothing else. If you just made the minimum payment, according to the credit card company’s formula, at a 20% interest rate it would take 20 years to pay this bill. In addition, you would spend many times more on interest payments than you did on the entire expense you had incurred.

(Incidentally, the credit card interest in India is close to 40%.)

When you pay compound interest, you pay interest on top of principal and interest. If you borrow Rs 100000 from a friend and pay him compound interest once at the end of the year at 12 percent, you would owe him

Rs 112000. If he compounds your interest monthly you would owe him

1 percent each month on Rs 100000, which would amount to a few extra Rupees each month for a total of Rs1,12,680 at the end of the year.

If you borrow money @ 12% and pay only the interest every month, like in a Cash Credit account, you would have paid the amount equaling the principle amount in 6 years and the principle will still be outstanding.

Just as compound interest and proper saving can make retirement possible, reverse compound interest can limit or indefinitely delay the same possibility.

You must begin by becoming aware of the choices you are making and how those choices impact your future. Things don’t just happen to you in life, they happen because somewhere along the line you made a choice that led to that moment.

To find radical change in every area of your life, you only need to take a series of tiny steps, but you need to do so consistently over a long period of time to improve your life.

Start your investment journey early and reap the benefits. Consult your financial advisor today to reap the power of compounding to your advantage.

Happy Investing!!

Stay Blessed Forever

Sandeep Sahni

You may contact us at:

91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com,info@sahayakassociates.com

Follow us on:

www.sahayakassociates.in, www.facebook.com/sahayakassociates,www.twitter.com/sahayakassociat,

Note: All information provided in this blog is for educational purposes only. They don’t constitute any professional advise or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.