The BSE Sensex, The benchmark index, made new highs on the 2019 results day and scaled the hallowed 40000 Mark, achieving a growth of 400 times in 40 years.

The 30-share Bombay Stock Exchange sensitive index (BSE Sensex) has forever been the barometer of India’s growth since inception in 1979. When someone says ‘Sensex’, it is synonymous with the stock market in India.

At a record high of 40000, the barometer has traversed a path through many peaks and bottoms and has reflected the Indian Economy in many ways.

The term Sensex was coined by Deepak Mohoni, a stock market analyst and is derived from the words Sensitive and Index.

The BSE SENSEX (also known as the S&P Bombay Stock Exchange Sensitive Index or simply the SENSEX) is a free float market weighted stock market index of 30 largest and most actively traded stocks, representative of various sectors of the Indian economy.

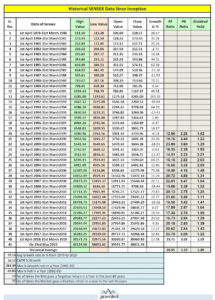

Published since 1 January 1986, the S&P BSE SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX was taken as 100 on 1 April 1979 and its base year as 1978–79.

The index is calculated based on a free float capitalisation method, a variation of the market capitalisation method.

The S&P BSE Sensex is a reflection of the evolution of the Indian economy, having passed many milestones in the last 40 years. The benchmark closed for the first time above the 10,000 mark in 2006, above 20,000 in 2007 and reached 30,000 in 2017 and crossed 39000 on its 40th Birthday on 1stApril, 2019 and again on 20th May after the release of the Exit polls which gave a clear majority to the NDA government.

MILESTONES: SENSEX JOURNEY

Sensex at 1,000: The Sensex crossed the 1,000 mark for the first time in 11 years (since its launch) in 1990 on the back of good monsoon and upbeat corporate results.

Sensex at 5,000: The sensitivity index of the BSE climbed to 5,000 mark in 1999 backed by the boom in the technology sector.

Sensex at 10,000: Owing to a sharp run in commodity pricing, Sensex touched the 10,000 mark in 2006.

Sensex at 20,000: On the back of the rise in investments from foreign institutional investors and aggressive retail buying, Sensex touched the 20,000 level for the first time in 2007.

Sensex at 25,000: Post the subprime crisis in 2008-09, which negatively impacted the economy and the investor sentiment, the benchmark index bounced back to hit a new high of 25,000 in 2014 after the NDA formed a stable government.

Sensex at 30,000: Sensex spurred to 30,000 backed by global liquidity provided by central banks of major economies in 2017.

Sensex at 36,000: Sensex touched record high of 36,000 in January 2018 on the back of IMF’s prediction about India’s growth, which boosted the investor sentiment.

Sensex at 38,000: Sensex crossed the 38,000 mark in August 2018 on account of India’s economic growth expectations.

Sensex at 39,000: Sensex achieved this figure on its historical 40th Birthday during the pre election rally and FPI inflows and again on 20th May after the release of the Exit polls gave a clear majority to the NDA government.

Sensex at 40,000: Sensex scaled the hallowed mark on 2019 results day on the back of a clear mandate to the NDA for a second time.

The Sensex has given a compounded annual growth rate (CAGR) of 16.1% in the period from 1979 to 2019. If you take the total return index, then this is well over 17%. In the same period, gold gave a rupee return of 10%.

Simply put, Rs 10000 invested in Sensex in 1979 has grown to Rs 39 Lacs currently. The same amount of money invested in gold over the same period would be worth ₹4 lakh today and in bank fixed deposit would have grown to a little over ₹2.5 lakh, without factoring in the tax. This clearly highlights and reinforces the fact that nothing can beat equity as an asset class, as an instrument of wealth creation over the long term.

Ashok Chauhan, the MD & CEO of BSE rightly said, “If you look at the chart of Sensex since the beginning, you will be able to see that when India smiles, the Sensex smiles, and when India cries, the Sensex cries too. It is a witness and representation of India’s victories and struggles, its hopes and worries. It is a measurement that shows India in its myriad true colours. It is the symbol of India’s aspirations and it will continue to guide India’s future generation as it has done in the past.”

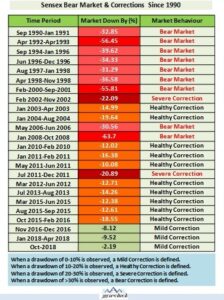

The spectacular journeyin which the Sensex has grown 400 times in 40 years, has not been a linear upward journey but a volatile one with its share of ups and downs.

Amongst the world’s ten largest stock markets, the Indian stock market has the highest level of churn. On average over the past 20 years, churn in the market has been around 50% i.e. if we begin the decade with 30 companies in the Sensex, by the end of the decade only 15 are left. However, this average churn of 50% does not tell the whole story – An analysis of Sensex churn across 10-year windows reveals that churn peaked at 67% (or 20 replacements in a 30- stock index) in the years following the 1991 reforms (1993-1995). From those levels, Sensex churn has fallen to a low of 27% (8 replacements) in the period from 2004 to 2014. Going forward, expect a reversion to 50% churn, implying that around15 companies will exit the Sensex in the next decade.

Though there have been corrections and regular bear markets, the Sensex has maintained a long term upward trajectory and has always rewarded those who have shown patience and have had the conviction to stay invested through the volatility of the market.

Going forward, the India growth story remains intact, with our GDP slated to touch the hallowed $5 trillion mark in the next 5-7 years. There is always a direct correlation between GDP growth and Sensex growth. (Read our earlier blog on the subject, https://www.sahayakassociates.in/resources/our-blog/2553-sahayak-associates/sahayak-associates-blog/8616-chronological-lottery )

In the last 40 years, The Sensex has given a 16.16% CAGR to reach 40000 from a start of 100. This growth has come in the Sensex despite, two prime ministers being assassinated, 10 different governments, unfair share of natural disasters, poor infrastructure, major financial scandals like the Harshad Mehta & the Ketan Parekh scam, lack of regulations, transparency and government controls, Global crisis like Dot Com Bubble, Iraq war, 9/11, Sub Prime crisis of 2008, and at least three major recessionary periods and Bear markets.

Going forward, with India being the faster growing economy in the world, much improved infra, high level of Digitisation, an over zealous SEBI and RBI with improved controls and regulations, the going should only get better.

However even if the Sensex maintains the same growth rate of 16% CAGR, it will touch a level of 97456 by 2025, a level of 429,920 by 2035, 18,96,565 by 2045 and a level of 1,51,48,846 by the time next 40 years are completed. Putting it another way, if a 25 year old does a SIP of Rs 40000 per month in an index fund, when he retires @ 65, he can have a retirement income of Rs 1.51 cr per month for the rest of his life.

Hence, if you believe the India story and have the conviction that our GDP and the economy will continue to remain one of the fastest growing economies in the World, be rest assured that the Bull run will continue and the Sensex will continue to scale new Peaks and possibly touch the six digit mark in the next five years.

Here is to new Peaks of the Sensex and continuous growth.

Happy Investing!

Stay Blessed Forever

Sandeep Sahni

Note: All information provided in this blog is for educational purposes only and does not constitute any professional advice or service. Readers are requested to consult a financial advisor before investing as investments are subject to Market Risks.

About The author

Sandeep Sahni

Sandeep is an alum of IIM Lucknow with a Post Graduate Degree (MBA class of 1988). His also an alum of Shri Ram College of Commerce, Delhi University (B.Com. Hons. Class of 1985.)

Sandeep’s investing experience and study of the Financial Markets spans over 30 years. He is based in Chandigarh and has been advising more than 500 clients across the globe on Financial Planning and Wealth Management.

He has promoted “Sahayak Gurukul” which is an attempt to share thoughts and knowledge on aspects related to Personal Finance and Wealth Management. Sahayak Gurukul provides financial insights into the markets, economy and Investments. Whether you are new to the personal finance domain or a professional looking to make your money work for you, the Sahayak Gurukul blogs and workshops are curated to demystify investing, simplify complex personal finance topics and help investors make better decisions about their money.

Alongside, Sandeep conducts regular Investor Awareness Programs and workshops for Training of Mutual Fund Distributors, and workshops and seminars on Financial Planning for Corporate groups, Teachers, Doctors and Other professionals.

Through his interactions and workshops, Sandeep works towards breaking the myths and illusions about money and finance.

He also writes a well read blog;

He has also conducted presentations, workshops and guest lectures at Management institutes for students on Financial Planning and Wealth Creation.

He can be reached at:

+91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com

Follow us on:

www.facebook.com/sahayakassociates

www.twitter.com/sahayakassociat,https://www.instagram.com/sahayakassociates