With just a couple of months left for the financial year to end, and as the deadline for submitting the Form 12BB to your employer approaches, it is time you began making tax-saving investments — if you haven’t already.

For the uninitiated, tax saving is a complicated task.

In simpler terms, there are two ways to decrease your tax liability: exemptions and deductions.

A lot of people confuse between the two things and use them interchangeably.

An exemption is that part of your income which is exempted from the purview of income tax. Exemptions include some allowances (house rent allowance, leave travel allowance, gratuity, LTCG before this budget etc.)

Your tax slab will be decided after removing the exemptions.

Once that is done, you arrive at your gross taxable income.

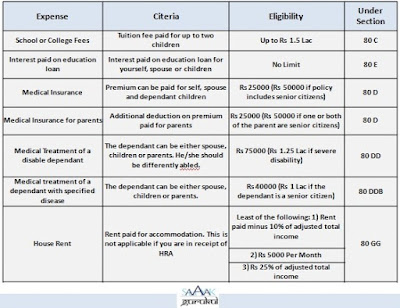

Now come deductions. They constitute specified avenues where you can invest or put your money in to decrease your tax liabilities even further. These may fall under many categories. In the table below we have provided the details of some of the popular deductions. Once you deduct these investments and expenses from your gross taxable income, you are left with your taxable income.

Under Section 80 C, Most of the products available as tax saving products are debt products like PPF, Tax Saving FD’s, and Sukanya Samridhi Yojana etc. except two products, i.e. ELSS & ULIP.

For a very long time now, Traditional insurance covers like endowment policies and PPF have been India’s most favourite “Financial Investment” and tax-saving instrument to get the Section 80-C benefit. It has served most of us who aren’t privileged enough to get an inflation-linked government pension. Its sibling, the EPF has employers chipping in and many of us don’t have that luxury either.

The PPFs are totally funded from our own pockets. It’s been our only friend in the battle against inflation, medical costs and some semblance of contingency or retirement planning. An assessee can claim deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act for investments in specified instruments and save a tax amount of Rs 46350.

However, the first thing to be kept in mind is that when you invest in the tax saving instruments, make sure that they are in sync with your overall financial plan, risk appetite and broader Asset allocation strategy. Tax Saving products should also help you move closer to your financial goals. Random, one-off investments in products selected without due care can do a lot of harm to your financial health in the long term.

Hence, fulfill your insurance needs first: To decide where to invest for tax saving, examine the gaps in your financial plan. First, check if you are adequately insured. Then move onto deciding to invest in Debt or Equity as per your broader Asset allocation Strategy.

To check which makes a better investment, we present 20 years of historical data, from 1999 to 2018 of the PPF, Equity Linked Savings Scheme (ELSS) and a pure index investment. The result revealed the terrible underperformance by PPF.

For the sake of parity, we took the average returns of the ELSS category. So, we considered a Rs 1.5 lakh investment every year (The total invested corpus of Rs 30 lakhs), starting in 1999 and ending in 2018.

The corpus in PPF grew to Rs. 76.8 lakh, (And this was when PPF used to carry an interest as high as 12%), whilst an investment in an ELSS fund would have added up to Rs 2.01 crore, almost 2.7 times higher! Simply investing in the index itself would have also given a decent return of Rs 1.45 crore, which is almost double the PPF return.

The post-tax returns on ELSS and index fund would be slightly lesser by 10% but they would still beat PPF returns hollow.

So, it might not be a bad idea to get out of one’s comfort zone and explore the ELSS route, even if partly.

The best way to invest in an ELSS is through a SIP, which helps you average the cost of purchase and thus offers better returns. It also ensures a discipline in investing and nothing is left for the last minute decisions, thereby ensuring that you don’t make any rash investment decisions.

31stMarch is not too far away, Consult your financial advisor, analyse your financial goal plan and initiate your Tax planning investment at the earliest.

Happy Investing!

Stay Blessed Forever!

Sandeep Sahni

You may contact us at:

91-9888220088, 9814112988

sandeepsahni@sahayakassociates.com,info@sahayakassociates.com

Follow us on:

www.facebook.com/sahayakassociates,

www.twitter.com/sahayakassociat,